Understanding How the Federal Reserve Sets Interest Rates: A Guide for Home Buyers and Sellers in Lebanon

1. The Fed Sets Short-Term Rates—but Not Mortgage Rates

The Fed controls something called the federal funds rate. That’s the rate banks charge each other for overnight loans. While this rate doesn’t directly set mortgage rates, it has a domino effect.

Here’s how: The prime rate, which banks use as a base for loans and credit cards, usually tracks about 3% above the federal funds rate. While mortgage rates don’t follow the prime rate exactly, changes in short-term rates tend to ripple through the financial system, eventually reaching home loans.

So when the Fed raises rates, borrowing tends to get more expensive. And when it lowers them, it can make financing cheaper, including home mortgages.

2. The Fed Uses Monetary Policy to Move Rates

The Fed has a few tools to influence the economy, but its biggest lever is monetary policy. That means adjusting the money supply to either stimulate growth or slow things down.

- When the economy needs a boost (like during a recession), the Fed may buy government bonds, pumping money into the financial system and lowering rates.

- When inflation is high or the economy is overheating, the Fed might sell bonds and pull money out of the system, which pushes rates up.

These moves are designed to create balance, but they also affect your bottom line when comparing mortgages or pricing your home for sale.

3. The Fed Responds to Economic Conditions

The Fed doesn’t make decisions in a vacuum. It watches inflation, job growth, wage data, consumer spending, and more. If things look strong and inflation is creeping up, the Fed may raise rates to keep things from getting too hot. If the economy is slowing or unemployment is rising, it may lower rates to encourage more borrowing and investment.

For real estate in Lebanon, that means interest rates can shift based on broader economic trends. And those shifts impact how many buyers are in the market—and what they can afford.

4. Fed Decisions Can Influence the Housing Market

Even though the Fed doesn’t set mortgage rates directly, its decisions often affect them.

- Higher interest rates mean higher mortgage payments, which can reduce buyer demand. That can cool off the market and slow price growth.

- Lower interest rates make it cheaper to borrow, which can bring more buyers into the market. That tends to push prices higher and speed up home sales.

For sellers, this can affect how quickly your home sells and for how much. For buyers, it changes what kind of home you can afford—or whether it makes sense to wait.

5. Other Things Affect Rates, Too

It’s not all about the Fed. Mortgage rates are also shaped by other factors, including:

- Inflation expectations

- Global financial events

- Supply and demand in the bond market

- Investor confidence

In other words, interest rates can be a bit unpredictable. Just because the Fed takes one action doesn’t mean mortgage rates will follow in a straight line.

Bonus: Mortgage Rates Are More Tied to the 10-Year Treasury Than the Fed

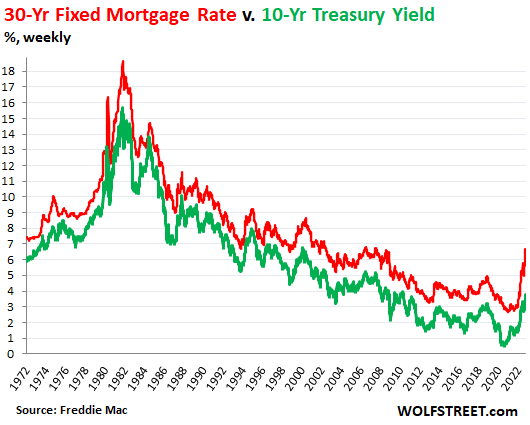

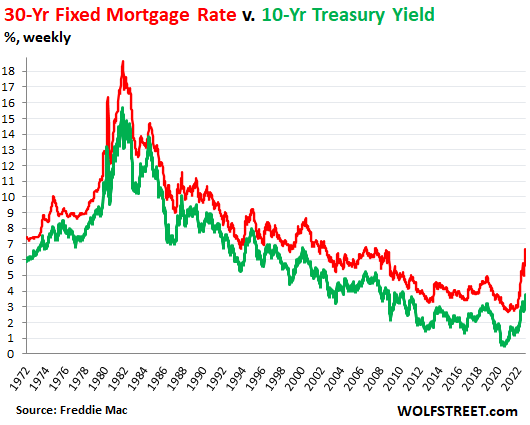

Many people don’t realize that mortgage rates usually track with the 10-year Treasury yield—not the Fed’s rate.

Why? The 10-year Treasury is considered one of the safest long-term investments. Mortgage lenders use it as a benchmark because it reflects investor expectations about inflation and long-term growth. Mortgage rates typically run about 1.75–2% higher than the 10-year yield.

So what moves the 10-year yield?

- If the economy is uncertain and investors want safe assets, demand for Treasuries goes up. That pushes the yield down—and mortgage rates tend to follow.

- If investors expect inflation or economic growth, they might sell Treasuries. Yields go up, and mortgage rates rise with them.

That means the Fed does play a role—especially in setting the tone for markets—but it’s not the only player. Right now, in May 2025, the 10-year Treasury is hovering around 4.33%, and the average 30-year fixed mortgage is near 6.76%(FRED).

Keeping an eye on the 10-year yield is often a better way to anticipate where mortgage rates are headed than watching the Fed alone.

What It All Means for Buyers and Sellers in Lebanon

Whether you’re house hunting or putting your property on the market, interest rates matter—a lot. They affect what you can afford, what buyers are willing to pay, and how quickly homes are selling.

The takeaway? Stay informed. Watch both what the Fed is doing and what’s happening with the 10-year Treasury yield. And if you’re not sure how current rates could affect your real estate goals, reach out to a local expert who can walk you through your options.

Want to talk about how today’s rates could shape your next move? Call or text me anytime at (603) 443-3149. I’m always happy to help you navigate the market with confidence.

Sources

- Federal Reserve Board – H.15 Selected Interest Rates

https://www.federalreserve.gov/releases/h15/ - Investopedia – How the Federal Reserve Sets Interest Rates

https://www.investopedia.com/articles/markets/082619/how-fed-interest-rates-affect-you.asp - Federal Reserve Economic Data (FRED) – 10-Year Treasury Constant Maturity Rate

https://fred.stlouisfed.org/series/DGS10 - Federal Reserve Economic Data (FRED) – 30-Year Fixed Mortgage Average in the United States

https://fred.stlouisfed.org/series/MORTGAGE30US - CBS News – Will Mortgage Rates Fall After the May 2025 Fed Meeting?

https://www.cbsnews.com/news/will-mortgage-rates-fall-after-fed-meeting-may-2025/ - U.S. Department of the Treasury – Daily Treasury Yield Curve Rates

https://home.treasury.gov/resource-center/data-chart-center/interest-rates - Business Insider – Today’s Mortgage Rates Update

https://www.businessinsider.com/todays-mortgage-rates - Wikipedia – Prime Rate

https://en.wikipedia.org/wiki/Prime_rate